pinellas county sales tax on commercial leases

On January 1 2020 the Florida sales tax rate on commercial leases will be reduced yet again for the third time in the last three years. If you contract with an agentregistered platform to rent your property they should collect and pay the TD tax.

Tangible Personal Property State Tangible Personal Property Taxes

Local Option CVB Reports.

. Effective January 1 2020 the State of Floridas sales tax rate on commercial real property lease payments including base rent and additional rent was reduced from 57 to. In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county. Some counties impose one or more local option taxes on taxable transactions within the county and on the lease or rental of living or sleeping or housekeeping accommodations transient.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Pinellas County Florida is. 1 2018 lease payments in Miami-Dade County will be taxed at a rate of 68 percent because Miami-Dade County imposes a local surtax at a one.

For example beginning Jan. However if the agent fails to collect and pay the tax the owner will be held liable for. Pinellas County Tourist Development Tax Code.

The Florida sales tax rates on commercial leases remains at 55 for 2022. The rate will be reduced from 57 to 55 for payments received. New Vehicle MCO 7975.

This is the total of state and county sales tax rates. Effective January 1 2020 the State of Floridas sales tax rate on commercial real property lease payments including base rent and additional rent will be reduced from 57 to 55 for. Last April Senate Bill 50 provided a route to reduce the state sales tax rate on commercial leases.

Search Pinellas County commercial real estate for sale or lease on CENTURY 21. The sales tax rate for pinellas county was updated for the 2020 tax year this is the current sales tax rate we are using in the pinellas county florida sales tax comparison calculator for. Commercial Lease Lawyers will help you understand why you pay sales tax in office and retail leases for CAM items not otherwise taxable.

The rate will be reduced from 57 to 55. Late Friday Governor Rick Scott signed Senate Bill 620 into law further reducing the State of Floridas sales tax rate on rental payments for the lease of commercial real property. What is the sales tax rate in Pinellas County.

Find commercial space and listings in Pinellas County. For several years the state reduced the commercial rental sales tax rate small amounts with a reduction to 55 plus the local surtax effective January 1 2020. For example a Florida commercial tenant prepaying January 2020 rent in December 2019 will pay tax on such rent at the new reduced sales tax rate of 55.

Tax Certificate Tax Deed. The current total local sales tax rate in Pinellas County FL is 7000.

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

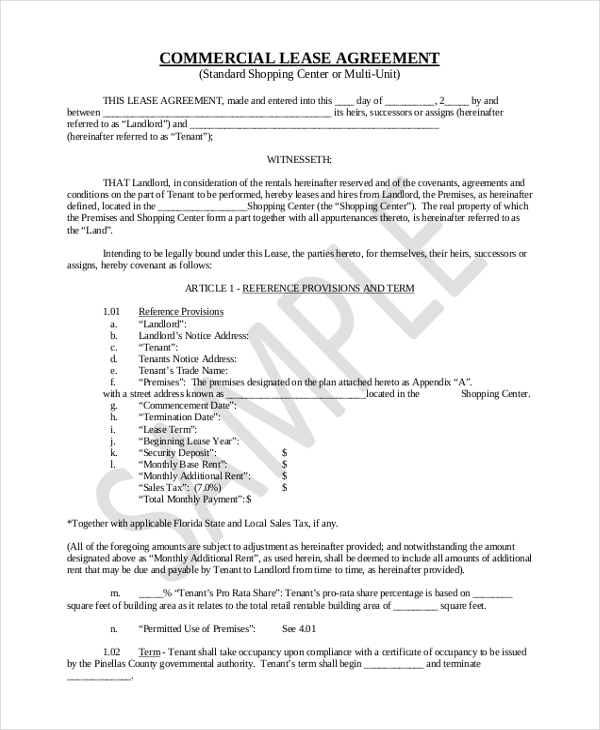

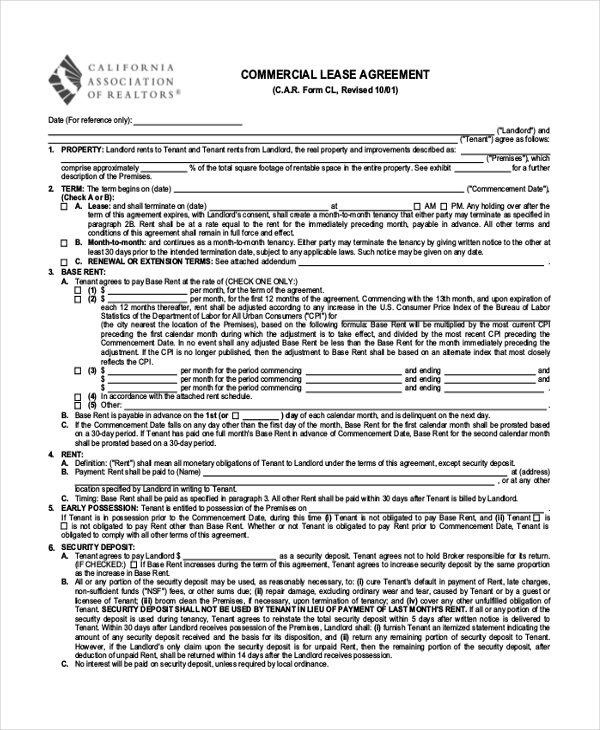

Free 9 Sample Commercial Lease Agreement Forms In Pdf Word

Florida Sales Tax Rates By City County 2022

Commercial Real Estate Rossrealtytampabay Com

Pinellas County Keeps 2021 Property Tax Rates The Same And Prepares For Covid 19 Impacts

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Florida Reduces Sales Tax Rate On Commercial Leases Mobiliti Cre

![]()

New Florida Residents Pinellas County Tax Collector

![]()

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Tangible Personal Property State Tangible Personal Property Taxes

Home Pinellas County Tax Collector

Your Guide To Prorated Taxes In A Real Estate Transaction

Tangible Personal Property State Tangible Personal Property Taxes

Florida Sales Tax Rate On Commercial Rent 2020