how to reduce taxable income for high earners australia

But 21 of the no tax-paying millionaires donated an average of 10099m. So the money was distributed to Mary.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Tax-deferred investment vehicles arent the same as tax-exempt such as a Roth IRA or HSA accounts.

. How do high-income earners reduce taxes in Australia. If you have a partner it can be possible to adjust your finances between you to optimise your tax circumstances. Because she stays at home she.

Tax deduction versus tax offset. How To Reduce Taxable Income For High Earners Australia. Adjust your finances with your partner.

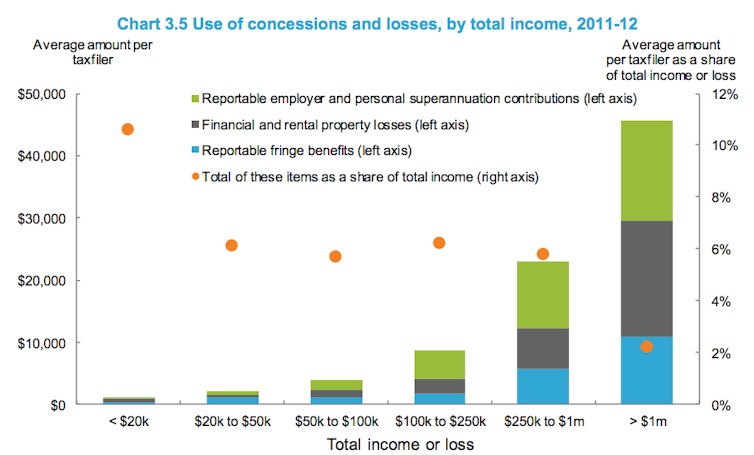

Salary sacrifice contributions to super are taxed at a special. To encourage middle to high-income earners to reduce their dependability on the public health system and make the private healthcare industry more sustainable. The 11 millionaires who were able to get their taxable income below 6000 donated a total of 158m.

This is a tax-effective strategy because super contributions. At some point there will be tax consequences associated with the. There were 70 people like Tony who earned more than 1.

Jane earns 230000 salary per year and has 2 adult children of 19 and 18. If youre a high-income earner in Australia it is wise to implement a tax minimization strategy. People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains.

Note that any depreciation taken while it was a rental property would still have to be recaptured. Based on new survey data an individual earning 1200 a week or more will have a higher income than the bottom half of Australians. According to Australian Bureau of Statistics data the average Australian now earns 62400 a year before tax an increase of 50 a week.

The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over. Note also that if you only live there for two out of five years before selling that. This is a cut-off date so any income earned or expenses incurred during this time are included in that year.

She also has a partner who earns a salary of 180000 pa. The top federal corporate income tax rate fell from 35 percent to 21. To claim a work- related.

But sometimes people drive down their income a great deal which greatly reduces how much tax they have to pay. For example if as a couple you. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

Individuals are entitled to claim deductions for expenses directly related to earning taxable income. By offering qualified retirement plans such as 401k 405b or 457 employers may attract employees qualified to. Grab a 0 tax rate on gains.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. Both are studying and will continue education for another 5 years. Using a Discretionary Trust to reduce taxes.

High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Maximizing all of your. Another great way to save money on taxes is to salary sacrifice a portion of your pre-tax pay into your super fund.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. The amount of offsets you get from your taxes.

How Do Taxes Affect Income Inequality Tax Policy Center

How To Calculate The Tax In Australia Quora

What Is Taxable Income And How To Calculate It Forbes Advisor

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Reduce Taxable Income Smart Ways To Save More Money Easi Australia

Contribution Of Top Ten Percent Earners To National Income Spain 2021 Statista

Worried About Taxes Going Up 9 Ways To Reduce Tax

How Do Taxes Affect Income Inequality Tax Policy Center

Are Elasticities Of Taxable Income Rising In Imf Working Papers Volume 2018 Issue 132 2018

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

How Do Taxes Affect Income Inequality Tax Policy Center

Calculating Income Tax Payable Youtube

How Do Taxes Affect Income Inequality Tax Policy Center

Supply Side Economics Wikiwand

What Is Taxable Income With Examples Thestreet

How Do Taxes Affect Income Inequality Tax Policy Center